The most common questions about startup stock options

A new funding round is great news but it often can significantly impact the cost to exercise your options. We break it down for you in this video.

0 result

People work at startups for a lot of reasons. The excitement of building something from the ground up, plus the promise of perks like unlimited vacation and free lunches gives employees incentives to work at less-established companies.

But the biggest perk for many is the ability to become an investor in their own company, and to share in its future financial success. So much so, that equity has become a standard part of compensation packages for new hires at startups.

While those stock options can potentially be worth quite a lot, most employees don’t fully understand how their stock options work. And companies rarely offer much education about it.

That’s why we’ve put together these short videos that answer some of the most common questions about startup stock options we get at Secfi.

You can also dive deeper with our guides on how ISOs are taxed and how NSOs are taxed to be prepared if you plan to exercise your options.

You can also check out this cashless exercise overview to learn more about the advantages and disadvantages, and if doing so is right for you.

This may be the question we get asked the most. Check out this article to learn a bit more about what happens to your equity and the options available to you.

If you’re asking this question, hopefully that’s because your company is going public. But many employees we’ve worked with still have questions, especially around the cost to exercise pre- and post-IPO, including tax implications. Here’s some more on what to know before an IPO.

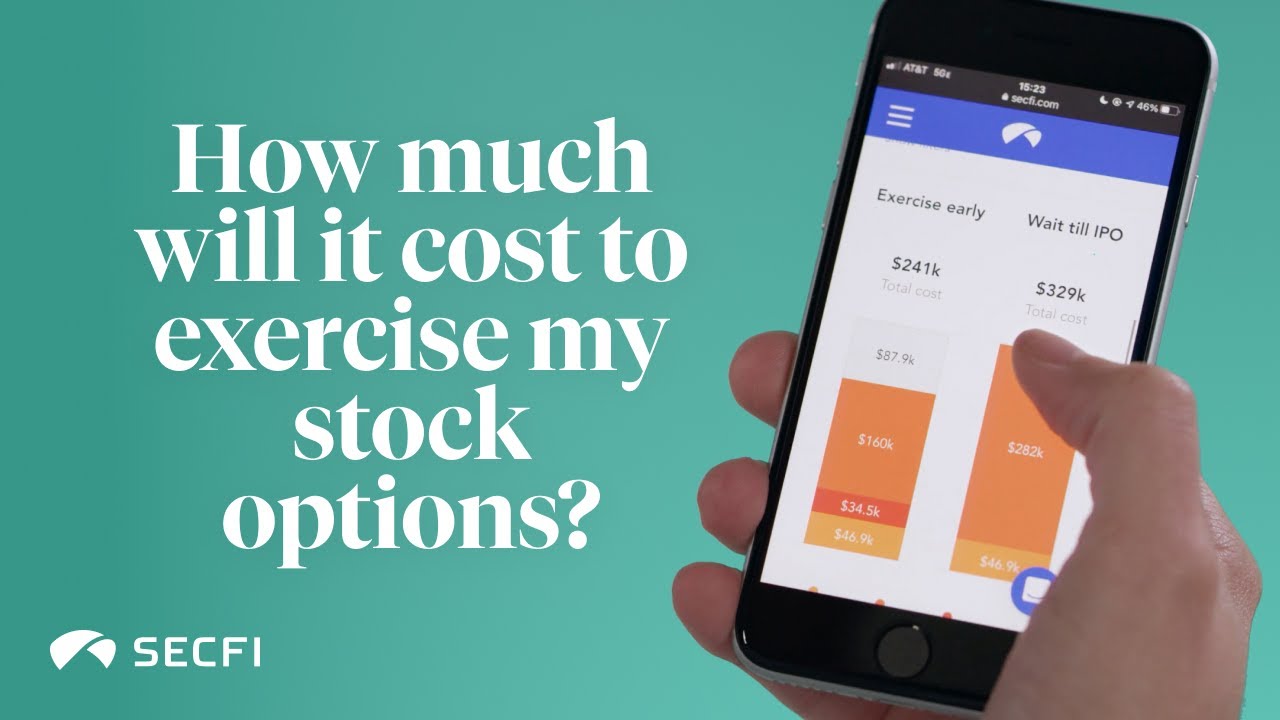

Exercising your options is likely more than you expected. We show you how to use Secfi's Stock Option Tax Calculator to see how much it will cost to exercise your stock options, including any taxes.

We show you how to use our Stock Option Exit Calculator to make an informed decision on when to exercise your stock options, including side-by-side comparisons of what it will cost before or after an IPO.

It may be possible to avoid paying AMT (alternative minimum tax) when exercising your ISOs. You can use our AMT Calculator to see how.

Thinking about financing the exercise cost of your stock options? Non-recourse financing may be a great option for you. We break down how it's different from a loan, how it works and why you won't owe anything if your company never exits. Seriously. You can learn more about non-recourse financing here.