10 min

0 result

If you work at a pre-IPO company that’s taken off and your incentive stock options (ISOs) are now worth a lot of money, you’re probably going to owe a lot of taxes once you exercise.

If you're unlucky, that tax burden — known as the alternative minimum tax (AMT) — may just cost you 8 times the amount of your exercise strike price. It could be even more than that — in principle, there’s no limit. Among Secfi clients, on average it's about 6.6x their strike price.

Because this often comes as a shock, a lot of our customers ask:

Can I avoid paying AMT on my ISOs (incentive stock options)?

It’s a natural question, especially if you just found out that exercising your options initially priced at, say, $15,000 leads to a tax bill of $100,000.

TL;DR

Technically, there are ways to avoid paying AMT (more on that below) — but the possibilities are limited, and it’s not always in your best interest to do so.

In many cases, financing your options exercise to cover the AMT can be a better alternative. It can save you money in the long run and provide you with flexibility if you want to leave your company before the IPO.

The alternative minimum tax (AMT) is a tax you may owe when exercising your incentive stock options (ISOs).

How does AMT work?

Your AMT builds up in parallel to your regular tax liability. After all your taxable income and deductions are taken into account, you pay either the AMT or your regular tax bill (whichever is higher).

Usually, your accountant or tax software like TurboTax runs your regular tax bill next to your AMT calculations. Most years, your regular tax is higher than the AMT, so you don’t need to pay the AMT and most people don’t even know it exists.

BUT…

The ‘phantom gains’ that come from exercising ISOs counts toward your AMT. Because it doesn't count toward your regular tax, this can tip the balance.

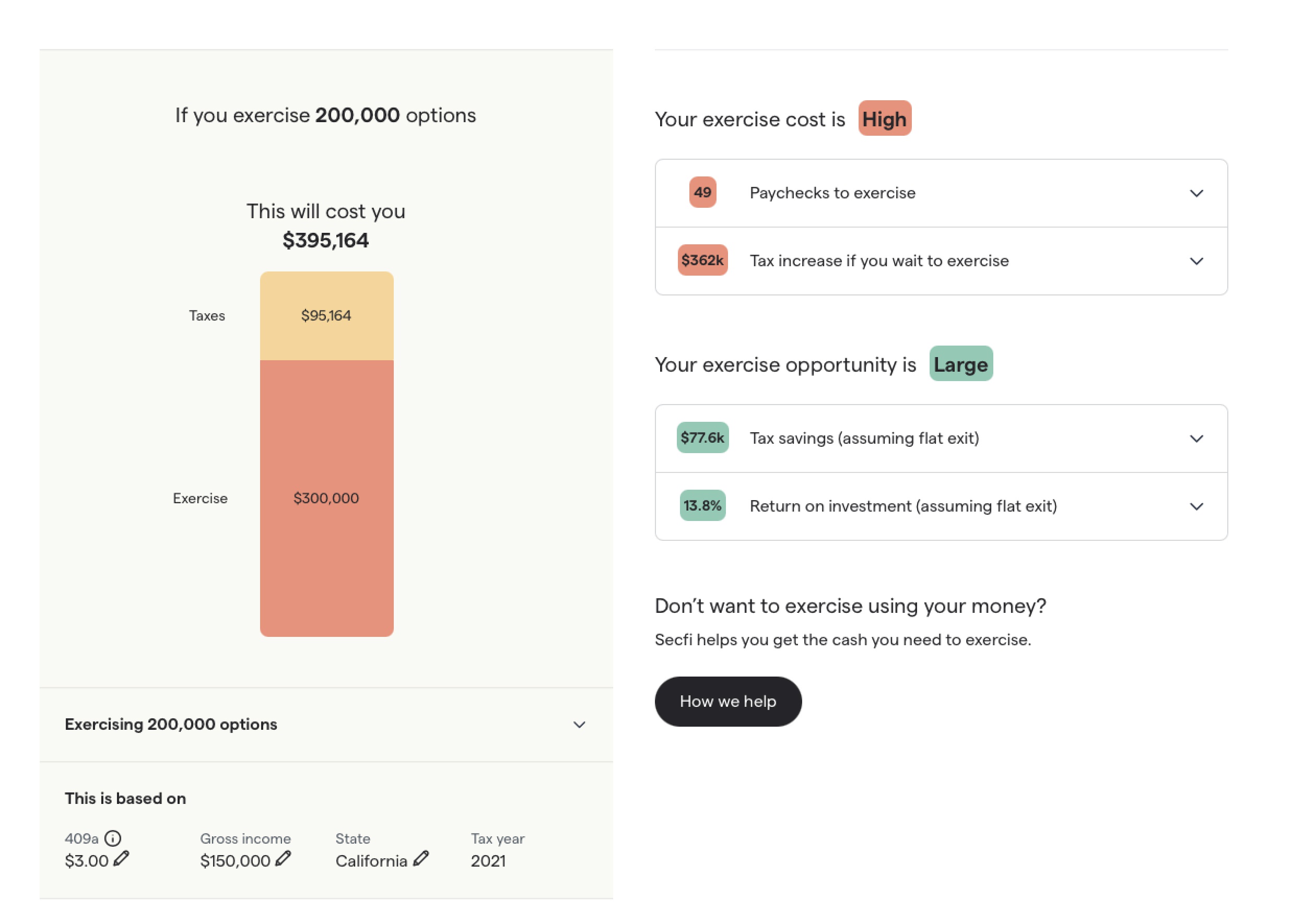

Note: If you’re curious about what your AMT might look like if you exercise your options, or whether you'd trigger it at all, use our free Stock Option Tax Calculator. Enter your details and get a breakdown of your total exercise costs, including state and federal AMT:

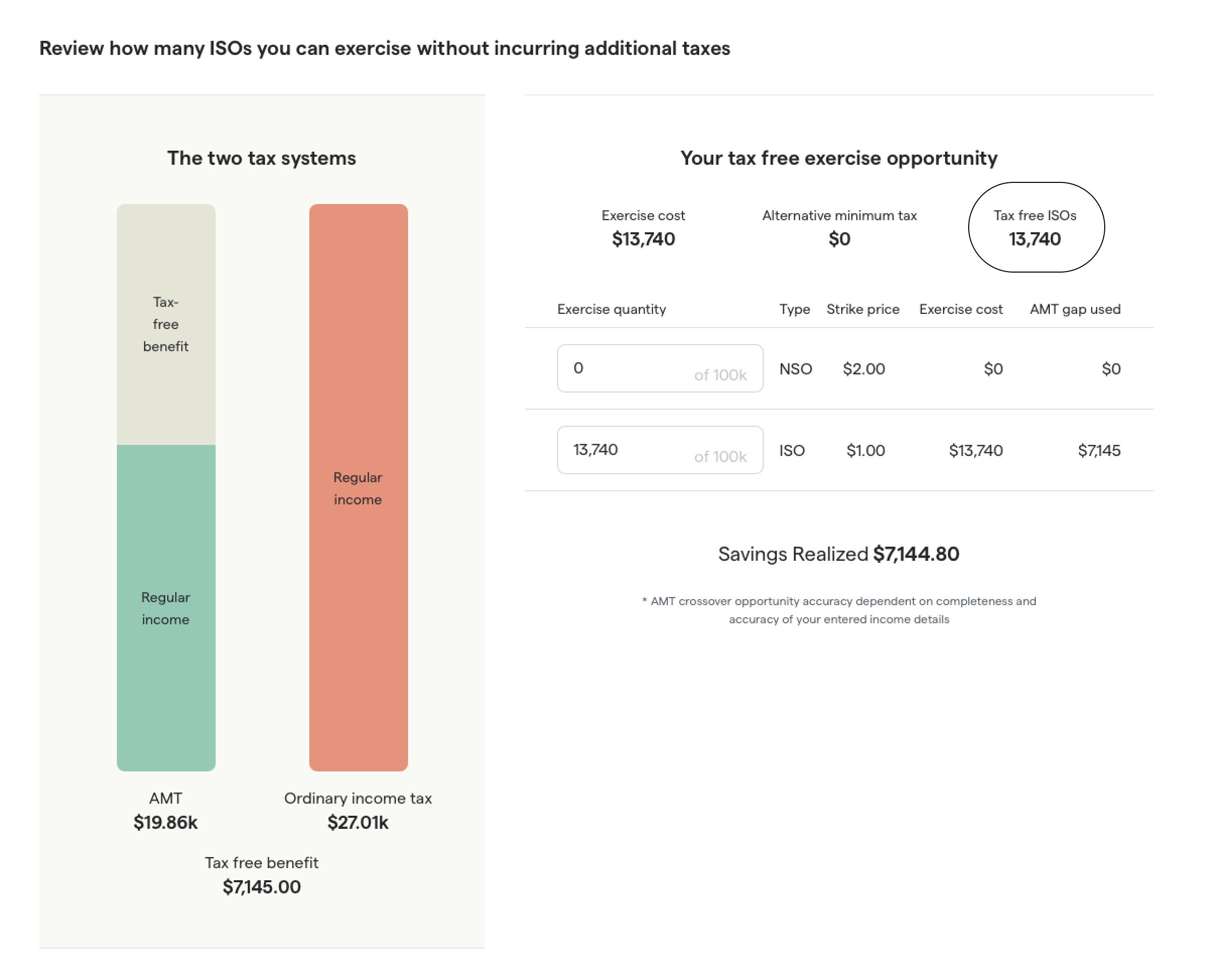

The way to avoid triggering AMT is by finding your so-called AMT crossover point. Basically, that's the gap left between your current income and the amount that would trigger AMT.

Using your strike price and the current 409A valuation (also known as fair market value), you can calculate how many options you can still exercise this tax year right before you hit the crossover point and have to pay AMT.

It's a difficult calculation to do manually, so we built an AMT Calculator to help you figure how many shares you can exercise before hitting the threshold:

When you sign up (which is free) and enter your equity details, you can find it under Insights in the menu.

This strategy can help you avoid paying AMT, and if you're optimistic about your company it's worth considering maxing it out every year. But it has its limitations.

Using the AMT crossover point strategy, you can exercise a portion of your ISOs tax-free each year.

But whenever the 409A valuation (a.k.a. fair market value) of your ISOs goes up, exercising each share counts more toward triggering the AMT.

Say that this year, you exercise 10 percent of your options to avoid AMT, but next year the 409A valuation of your company has gone up. Now the 'phantom gains' — that's the spread between the strike price and the 409A valuation — of the remaining 90 percent of your ISOs is higher, and you reach the AMT crossover point sooner.

Because of that, instead of 10 percent, this year you may only be able to exercise 5- to 7 percent of your remaining options to avoid triggering AMT.

If your company continues to grow, every year you’ll be able to exercise fewer and fewer options without paying AMT.

So with this strategy, it can be difficult to ever get all of your options exercised.

Say, theoretically, your company’s 409A valuation remains the same for the next 10 years and you can exercise 10 percent of your options each year without hitting AMT.

To pull this off, you’d have to stay at your company for 10 years to make it work.

Plus, the moment you leave your company, you’ll most likely have just 90 days to exercise before you lose all your remaining ISOs. (This is often referred to as the "golden handcuffs" problem that employees with a lot of stock options can run into).

Not really.

You could exercise a small percentage of your options without hitting AMT for awhile. But to make the highest amount of money with your ISOs in case of a successful IPO, you need to exercise them at least a year before you sell them.

That can give you a pretty nice tax discount, because you get the lower long-term capital gains tax rates.

Another option is to wait to exercise until the IPO and do what’s called a cashless exercise. Essentially, you can sell your shares on the same day that you exercise them and cover the cost of exercising (including the AMT you trigger) by selling a portion of your shares.

But in this case, you end up paying the highest tax rate possible on the portion you sell (i.e. you don't get that tax discount), so it’s also not ideal.

Finally, after your company has gone public, you could still exercise your options a bit at a time to avoid AMT. But again, you’d have to stay at your company the entire time it would take to do this for all of your shares.

Next to that, once the company has gone public and your equity is sellable, it's risky to keep all of that wealth locked up in a single stock. Because even though your company has done very well, you never know when circumstances change.

The frustrating thing about the AMT is that you have to pay it on gains that only exist on paper. You’re not making any real-world money yet just by exercising your options.

But the silver lining is that in later years, you can get back what you pay in AMT in the form of the AMT credit.

Any year in which you pay AMT on top of your regular tax liability, you get the surplus as AMT credits. In future tax years where you don't owe AMT, you can use that AMT credit as a dollar-for-dollar reduction on your tax bill.

Either you or your equity strategists need to keep track of the AMT credit every year going forward to make sure you get your money back.

There is a yearly limit on how much AMT credit you can claim, so it can take years to recover past AMT payments (depending on how big the initial bill was). But not all startup employees are aware of this benefit, so it's good to know that it exists.

There are two other strategies, but these aren't always possible — it depends on your situation.

Note: if your company has grown a lot since the time you were granted your ISOs, the 409A valuation has probably already increased and this isn't an option for you.

If you believe in the long-term viability of the company, and you think there's going to be a successful exit (i.e. an IPO or acquisition) where you can sell your shares at a gain, you can choose to exercise as early as possible, to minimize taxes and to start the 12-month clock on long-term capital gains.

Assuming your company is growing, then the earlier you do it, the lower the 409A valuation (aka fair market valuation) will be. And that's the number determining your tax liability on exercise.

If your strike price is $1 per share and the fair market value is $1.05 per share, then you’ll very likely pay minimal taxes. In fact, if your company allows early exercising and you exercise your ISOs right after you get them, their strike price will be equal to the 409A valuation and you might not owe taxes on those ISOs at all.

The other option is to partner with a company that finances the cost of exercising (including any tax burden).

This is what we do at Secfi. Our financing is non-recourse, which means none of your personal assets or credit are on the line (like with a private loan). Instead, it’s backed by the shares you’re exercising.

You get to keep ownership of your shares and you’ll be able to exercise before your AMT burden continues to rise.

After the exit and when you've sold your shares you'll pay some of the gains you make back to us in the form of a fee. But in many cases — due to the tax savings you unlock — you're better off than if you waited until the IPO and performed a cashless exercise.

Another benefit of financing is that once you own the stock, you don't have to wait around until an IPO if you don't want to. If you want to walk away from the company before the IPO, you can, while keeping your equity. You essentially get rid of your golden handcuffs.

There are websites where you can sell stock options in a private company to a buyer, also known as secondary markets.

By selling some of your stock options, you can cover the costs of exercising the rest.

Not every company will allow you to do this. But if your company does, there are some downsides to consider. The biggest is that if you sell your options and your company’s value continues to rise toward a successful exit, you lose out on these gains.

While it’s natural to want to avoid paying AMT when you exercise your stock options, the ways in which you can do it are limited and usually not the best alternative.

For employees at highly valued startups, not avoiding but rather financing the AMT costs often saves you money in case of a successful exit — and you get rid of the golden handcuffs so you don't necessarily need to wait for an exit.