05:05

0 result

There are a number of strategies that let you exercise and reduce your tax bill. But most of these are ‘use it or lose it’ – you’ll have to take action by year end if you want to take advantage.

This article covers everything you need to know, all in one place – so you can get it over with in one go. (We know this is no one's favorite pastime.)

Vieje Piauwasdy, Director of Equity Strategy, breaks it down:

Some of the tax strategies only work with incentive stock options (ISOs), but the general advice applies to non-qualified stock options (NSOs) as well.

So whatever your situation, get yourself a good cup of coffee and let’s optimize that tax bill.

In this intro, we outline three important factors to take into consideration:

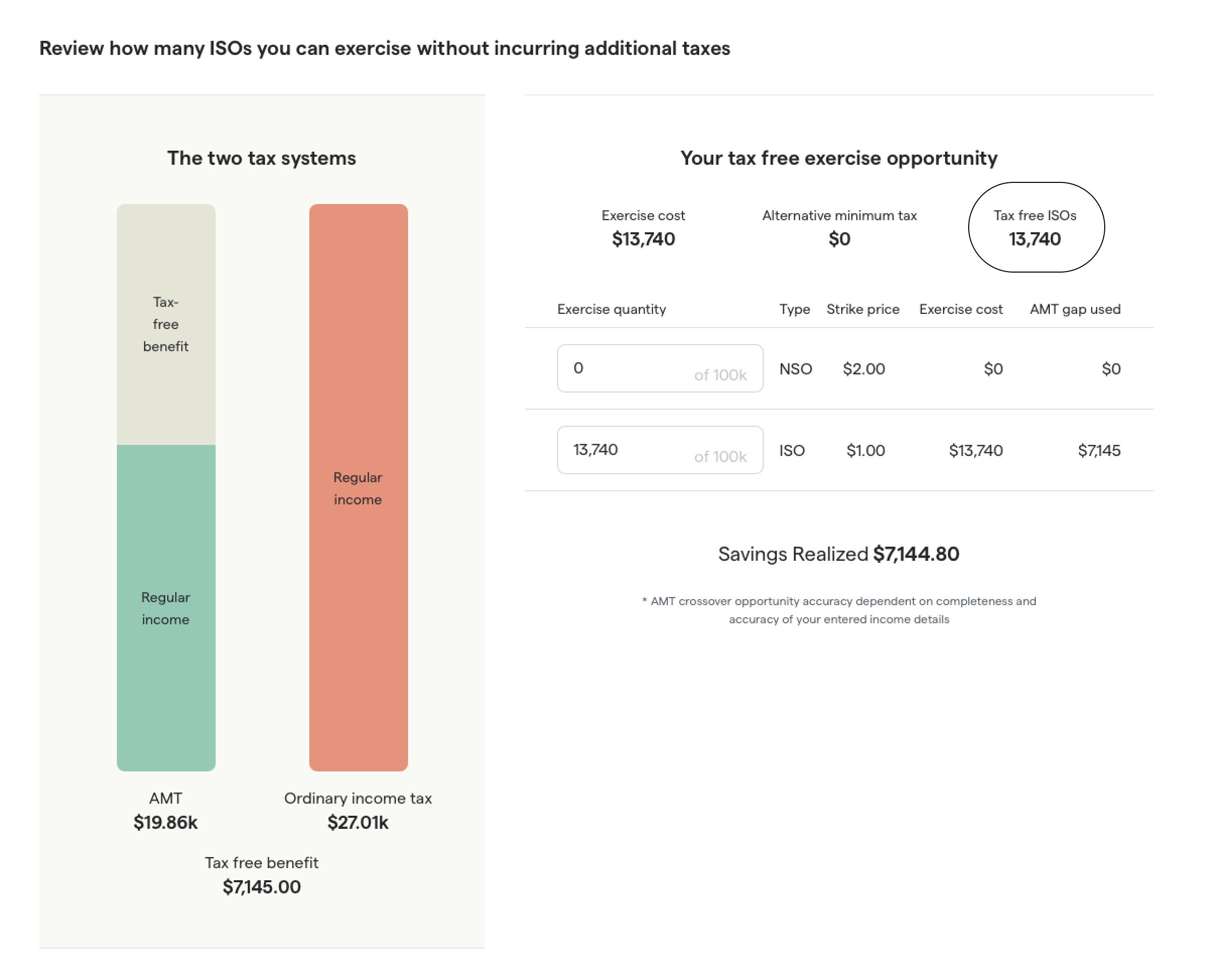

Here, we discuss the alternative minimum tax (AMT) dynamics that allow ISO-holders to exercise up to a specific amount of ISOs tax-free (in other words – won’t trigger a tax liability).

If you haven’t yet tried it, the AMT Calculator will help you determine exactly how many options you can exercise tax-free before the end of the year. It's free. Here's how to use it:

Et voilà:

If you exercise ISOs this year, triggering an AMT tax liability, you may be able to recover some of what you paid in years to come in the form of an AMT credit.

We know this is a lot to think about. We’re happy to talk to you about your individual situation and, if it makes sense in your situation, offer financing to cover the cost of your exercise.

Here are some potential next steps and resources to get you going: