7 min

0 result

When you receive stock options, your vesting schedule determines when you’ll gain ownership and the right to exercise them. These schedules are a key part of your equity compensation plan and understanding how they work can help you maximize your financial benefits.

Stock option vesting schedules are designed to encourage employees to stay with a company and contribute to its success over time. Without vesting schedules, employees could immediately exercise their options and leave.

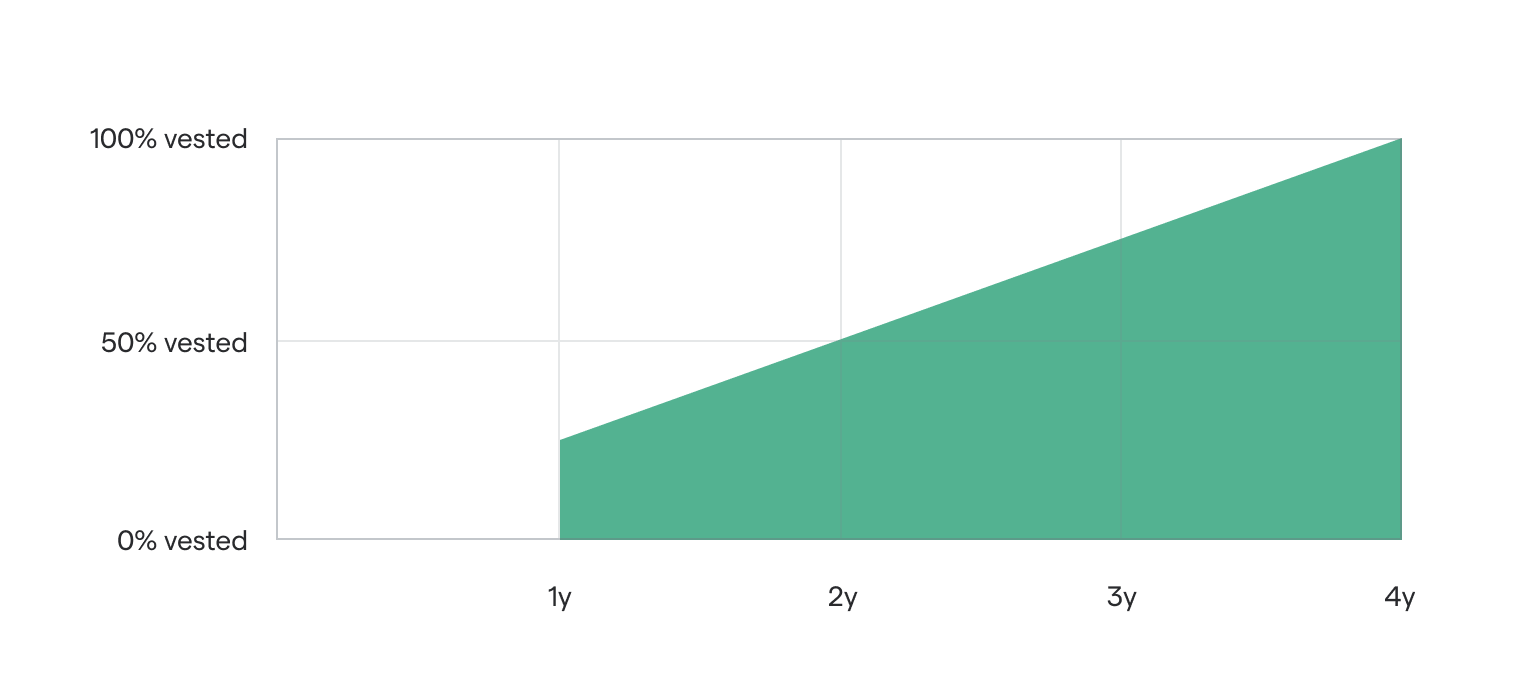

The most common schedule is a four-year vesting plan with a one-year cliff. Under this plan, employees earn ownership of 25% of their options after the first year, with the remaining 75% vesting gradually over the next three years.

Cliff vesting is a type of schedule where you don’t receive any options until you’ve reached a certain milestone, known as the “cliff.” Afterward, options vest incrementally.

For example, in a four-year vesting schedule with a one-year cliff:

This structure protects companies while rewarding employees who stay for the long term.

In this case, for the first year, you get nothing at all.

Then on day one of year two, you immediately own 25% of your options.

Then every month after that, you get 1/48th of your options until they’ve all vested at the four-year mark.

At that point, they’re 100% yours. (Although, of course, you’ll still need to exercise them.)

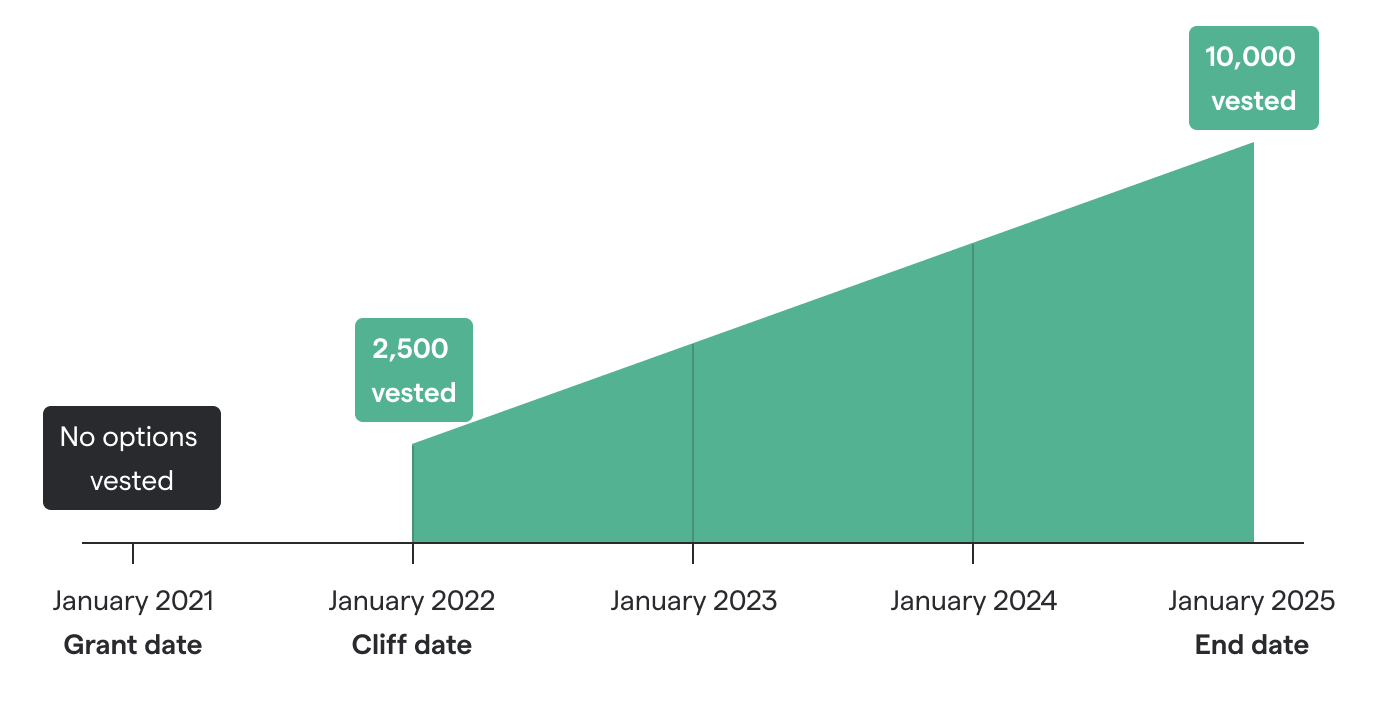

Let’s say Startup Inc. grants you 10,000 stock options on a four-year vesting period with a one-year cliff.

Here’s how that would play out:

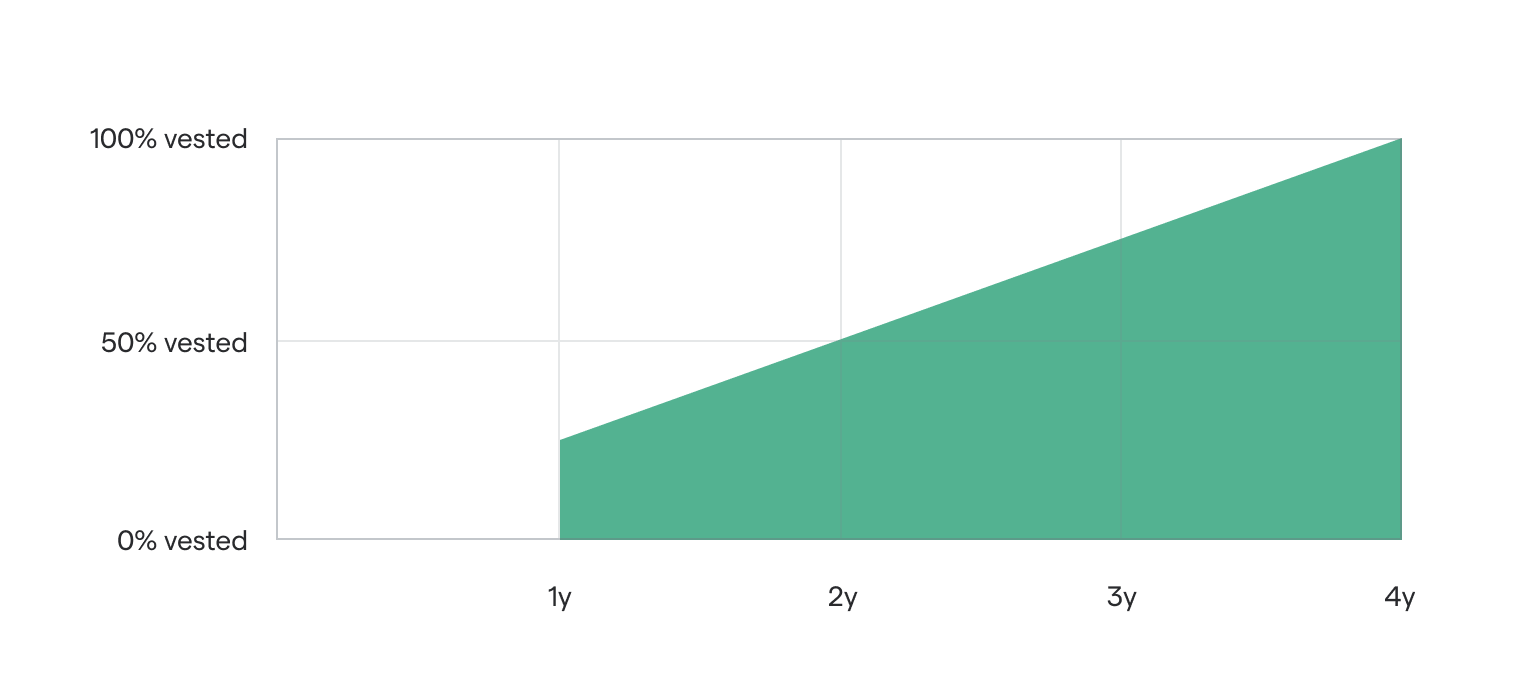

While a four-year vesting schedule with a cliff is the most common, it’s not the only vesting schedule out there.

The second most common is a four-year vesting period with no cliff.

Sometimes this happens when a company gives an employee a bonus options grant (also called a refresh grant). Since the company has already established a good relationship with the employee, rather than attaching a cliff to the bonus, the shares start vesting immediately over the next four years.

There are other types of vesting schedules out there (like a two-year period with a one-year cliff), but they aren’t very common.

Sometimes executives with more leverage negotiate their options to vest under a different schedule that works better for them, but you almost never run into these.

Once your options have vested, you now have the opportunity to exercise your options and purchase shares of the company.

If your company initially granted you 10,000 options, you can now buy up to 10,000 company shares at the strike price they were granted at. (That’s basically what an option is — a right to buy shares of the company at a set price, regardless of the current fair market value of those shares).

That means even if those shares are currently valued at $10, $20, or even $100 a share, you can still buy them for your original strike price — even if that’s just 50 cents a share.

Note that you’ll likely owe taxes on the difference between your strike price and 409A valuation (also known as fair market value).

No. Once they've vested, you can exercise as many or as few options as you’d like. There’s no restriction.

Every option comes with an expiration date. Most commonly, that’s 10 years after grant and 90 days after you leave the company.

That means that if you leave the company, you have to exercise the stock options within 90 days, or you'll lose them.

The 10 years after grant is a legal requirement, but the 90 days after you leave the company isn’t.

Some companies are more lenient, and allow you 3, 5 or even 10 years to exercise your stock options even after having left the company. In that case however, if your stock options are ISOs, they'll convert to NSOs, which has some drawbacks.

In some cases, yes.

Some companies will allow employees to do what’s called an early exercise.

Basically, early exercising means you can exercise your options before they vest and before you actually own them.

It’s a way to save on taxes if it looks like your company’s valuation will keep rising.

Even though early exercising is becoming more and more common, not every company allows it. So check with your HR or finance department to see if it’s an option for you.

Sometimes.

Typically once you have a grant, there's not really much you can do about the way that it vests.

But if there’s a special event, like an acquisition, sometimes the company will accelerate the vesting schedule.

So if you’ve been at a company for two years (and you’re on a four-year schedule), your company may accelerate your vesting upon acquisition so that all your options immediately vest and you can own shares in the new company.

We’re also seeing more companies take a friendlier approach to employee equity and vesting schedules when it comes to forced layoffs.

At the start of the pandemic, for example, a lot of companies had to let go of employees. Some of these companies accelerated their employees’ vesting schedule as a form of compensation.

Other companies accelerated the cliff for laid-off employees who hadn’t reached the one-year mark. That way, they got to keep at least 25% of their options.

It’s not very common, but it’s happening more and more often.

Your options will only vest while you are working at the company.

In the event that you leave before they fully vest, your vesting schedule will stop.

Anything that’s vested is yours to keep (though you’ll have a limited window to exercise them). Anything that hasn't vested will be returned to the company,

Let's say that you've worked at your company for three years and you decide to leave — 75% of your options will have vested and you’ll keep the possibility to exercise them.

Unfortunately, the remaining 25% won't belong to you. They’ll still belong to the company.

Your vesting schedule will be detailed in your stock option grant documents. These are the documents your company gives you when you get an offer.

Or, if your company uses an equity management platform (such as Carta), you can find the details of your vesting schedule there — as well as how many options have already vested.

Stock option vesting schedules are usually straightforward, but understanding them is critical to making the most of your equity. Once your options vest, decisions about timing, taxes, and strategy come into play. Take the time to plan and explore your options to maximize their value.