Stonks don't always go up (and that's okay)

By the numbers: The NASDAQ 100 is down over 28% this year, which includes companies that recently gone public

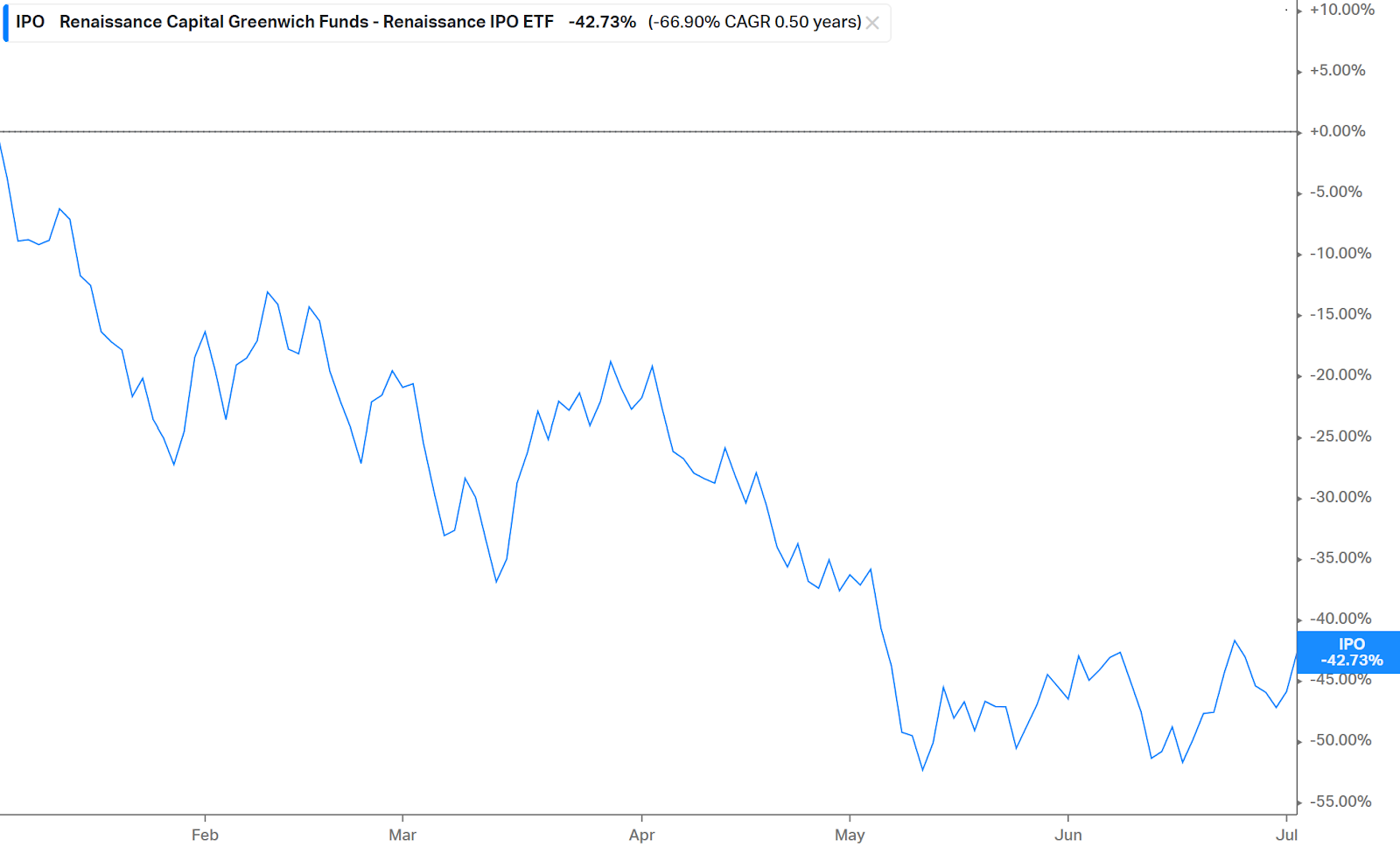

See the chart of $IPO which is an ETF that tracks IPO stocks:

0 result

By the numbers: The NASDAQ 100 is down over 28% this year, which includes companies that recently gone public

See the chart of $IPO which is an ETF that tracks IPO stocks:

Hey Secfi fam.

I’m Vieje, Secfi’s Senior Director of Equity Strategy, and I have the pleasure of authoring Secfi’s first ever newsletter (we’re tentatively calling it “Founders and Funders” but open to your alliterative suggestions).

You’ll hear from me, my colleagues, or some industry guests commenting on, and sharing insights about, topics that are near and dear to us: startups, equity, venture capital, investing, personal finance, and more.

Really, this is for you, so let me know what you think, what we can improve, or anything you’d like me to cover in the future by replying directly to this email.

Stonks don’t always go up (and that’s okay)

Just how brutal has this first year been? Well, it’s the worst first half of the year since 1970.

The benefactors of the V-shaped pandemic recovery are also those now being hit the hardest: Growth and tech.

Private markets and VC-backed startups are starting to feel the squeeze: Popular buy now pay later player Klarna announced that they raised $800m at a $6.7b valuation. Looks healthy…but it's an 85% drop from the $45.6B valuation they got during their last funding, only 1 year ago.

It’s just the tip of the iceberg. Stripe just announced they’ve cut their valuation by 28% — they’re internally valuing shares at $29, a drop from $40.

Unfortunately, I believe we’ll see more of these down rounds and 409A valuation cuts. For many millennials and Gen Z, this is the realization that stocks don’t always go up. (I don’t count the pandemic as that was a, hopefully, once-in-a-century anomaly).

So, what’s a startup employee to do?

1. First, reset your expectations. 2021 isn’t coming back. Capital was (nearly) free and companies received ridiculous valuations and multiples. Odds are slim that will happen again soon.

2. Next, take a deep breath. Startups go through a whole mess of ups and downs. I had many friends at Airbnb who were expecting an IPO in early 2020, only to have their revenue shoot to $0 overnight. Panic ensued, but calmer heads prevailed and they made it through.

3. Learn to ride the wave — it’s healthy. Both bull and bear markets come and go. In fact, corrections are healthy for the market.

Your equity may not be worth as much as it was last year, but that doesn't necessarily mean that it’s not worth anything. And that is the key thing to remember.

The market will bounce back at some point 🏀 — the only unknown is when. But know that it will.

Perhaps the 50x ARR multiple that your startup raised last year won’t come back soon, but the best companies will continue to grow their revenue, with their sights set on earning back the previous valuation using their huge piles of cash.

✍️ Lastly, come up with a plan for your equity. These downturns can be a great opportunity for you to create a plan for your options, if you haven’t already.

Those down rounds and cut 409A valuations? That could be an opportunity to “buy the dip” and get some massive tax breaks.

Even better, this is a great opportunity to create a broader financial plan for your life. A couple months ago, my fiance and I took this opportunity to discuss our financial goals and update our plan. It’s therapeutic once you get over calculating how much you’ve lost in the last few months, I promise.

Things we're digging:

Let me know what you think (the good, the bad) by replying to this email or reach out to me on Twitter.

-Vieje