0 result

It’s the dog days of summer. While it seems like the entire country is in a heatwave, San Francisco has been perfect at 75 and sunny every day. For the first time since the pandemic started, I’ve been feeling that the energy in San Francisco is starting to come back. Bars are starting to fill up and rent prices are astronomical again. I’ll remain cautiously optimistic about San Francisco being back.

I’m really excited about this week’s newsletter because it’s not only an amazing deep dive into what happens behind the scenes at running a startup, but because it’s also our first one written by a guest.

CJ Gustafson is a professional financial expert by day, and a gifted writer by night, managing the Mostly Metrics newsletter. Not only does he really know his stuff, but he’s able to distill complex topics into digestible pieces of content, which is Secfi’s goal too. And because he’s a Secfi user, I thought it’d be great to hear directly from our own community.

I’ll let CJ take it from here:

TL;DR:

Startups usually need a financial backing (e.g., debt or equity) of some amount to get going. 15 years ago, it used to be, say, a $3M Series A for 25% of the company (meaning an investor forks over that cash for a cut of the company pie). Some companies could operate on that for quite a while.

Over the last decade, though, there have been more rounds added to the mix (e.g., “pre-seed” all the way down to Series H). At the same time, valuations have grown, as VCs formerly focused on later stages have shifted left, driving up round sizes at earlier stages ($1B valuations for Series A are not unheard of any more).

Nonetheless, the point of raising money is to focus on aggressive growth and market opportunities, without being overly concerned about profitability in the early days.

Cash burn is simply the amount of money a company is using from their bank account to subsidize the shortfall from their current operational costs.

Burn = What you bill your customers - What you spend

“Cash runway” is the number of months a company has until it runs out of money in the bank. If you’re driving a car and look at the gas tank, how many miles do you have until you hit empty? This, of course, is dependent on how fast you’re driving. The harder you push the engine, the sooner you’ll sputter out on the side of I-95.

⏳Managing your cash runway is also dependent on your future capital strategy. Are you running the business with plans of raising again? Or do you want to become self-sustaining?

If you’re on the venture capital path, post-fundraise you typically want a cash runway of at least 18 months. This gives you 12 months to go out and make magic ✨ before coming back to the table with your coffers, plus another 6 month buffer in case the markets aren’t in great shape.

Here’s how a finance team may look at it:

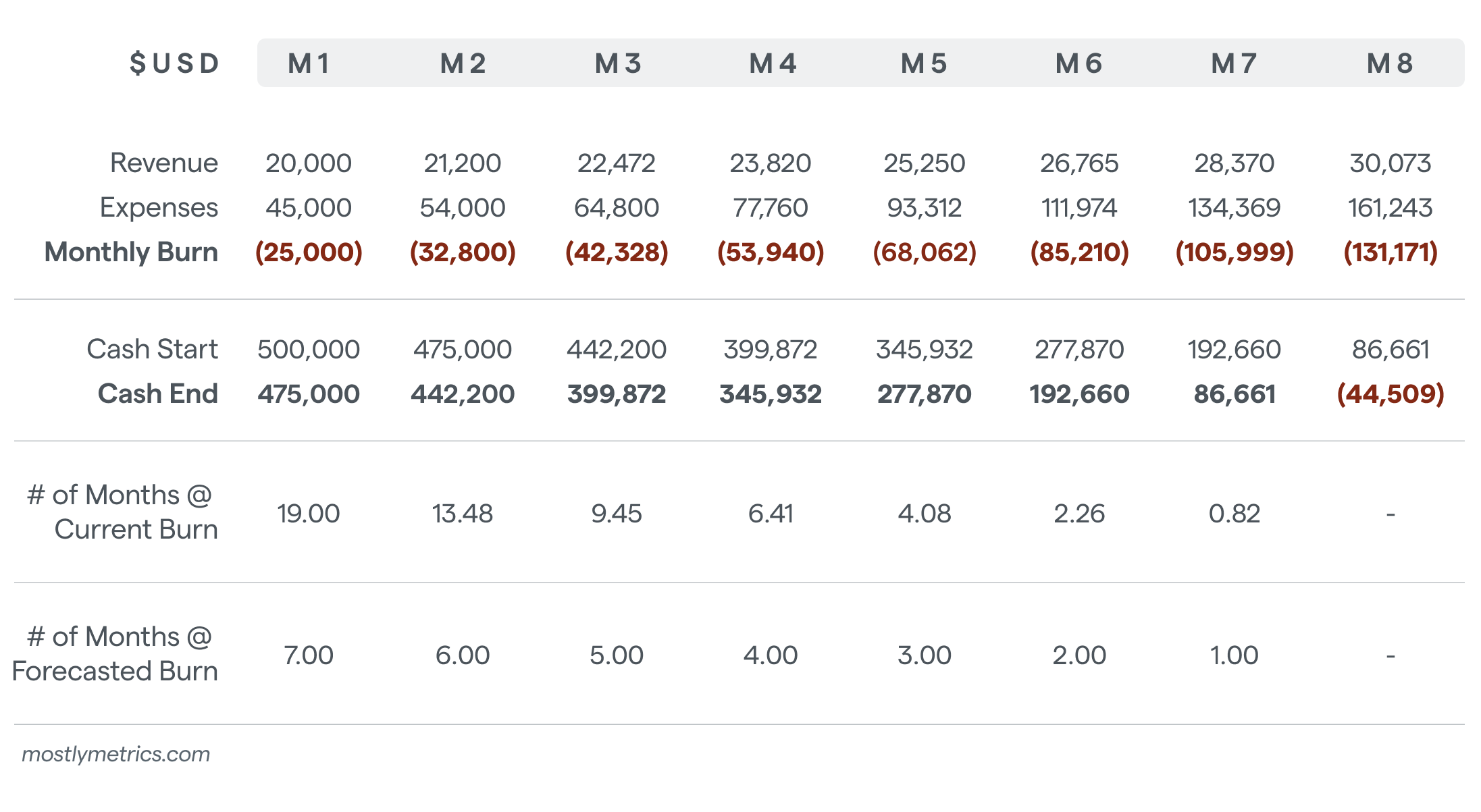

# of Months @ Current Burn = Your Ending Cash Balance for period / your most recent burn rate for the period

# of Months at Forecasted Burn = A count of the number of months until you go negative if you spend to forecast

Assumptions for the exhibit above:

This forecast tells us we either need a cash infusion going into month 8 (fundraise time!) or we need to scale back expenses to get to a healthier run rate (snip snip).

Investors know that you can’t trade a dollar for seventy-five cents forever (unless you’re Uber… still not sure how they are making that all work). That’s why they look at a number of different metrics to validate a company is not burning cash in vain.

For businesses losing money, my top five leading indicators when attempting to forecast future business success are:

Valuation is, at the end of the day, as much an art as it is a science . When you’re painting a picture, it’s hard to work with just one color. The same can be said when assessing a business — you need to know more than just its growth rate. Growth is a byproduct of a company’s monetization model, not a driver of it. And growth can have both healthy and unhealthy aspects.

Yes, we are in a market correction, and maybe we have over-rotated towards prioritizing free cash flow in the short term. But burning cash is NOT suddenly a definitively bad thing. It should just come with more sanity checks.

Actually, one of the biggest beneficiaries of this change will be employees. Raising cash usually signals a company is on to something. Startups use their fundraising events as recruiting tactics all the time. But if mediocre businesses are receiving premium valuations, there’s a disconnect. When cash is better gated, fewer potential employees will receive false signals and get wrapped up in ultimately bad bets.

For employees, joining a startup is the most important “investing” decision they make. So they should ask some of the same questions a traditional investor would ask when assessing long term business viability. Use the metrics above as discussion points to form a personal investment thesis.

😎 And pack sunblock when you choose which company to burn with — it’s never a straight line to profitability.

Back to you, Vieje.

__

Vieje here (not sure how to hand off the mic in a newsletter). Please, keep your feedback coming. Want to hear more from CJ? Other topics you’d like me to dive into? I’m all ears. This newsletter is for you and what you’re interested in.

Things we’re digging:

Looking forward to the next one. As always, let me know what you think or reach out on Twitter @viejep

- Vieje