We are thrilled to announce a new partnership between Secfi and Carta, two industry leaders with a shared vision of empowering equity compensation. By leveraging Carta’s robust APIs, this collaboration marks a significant step forward in simplifying equity management and wealth planning for founders, executives, and employees in the tech industry.

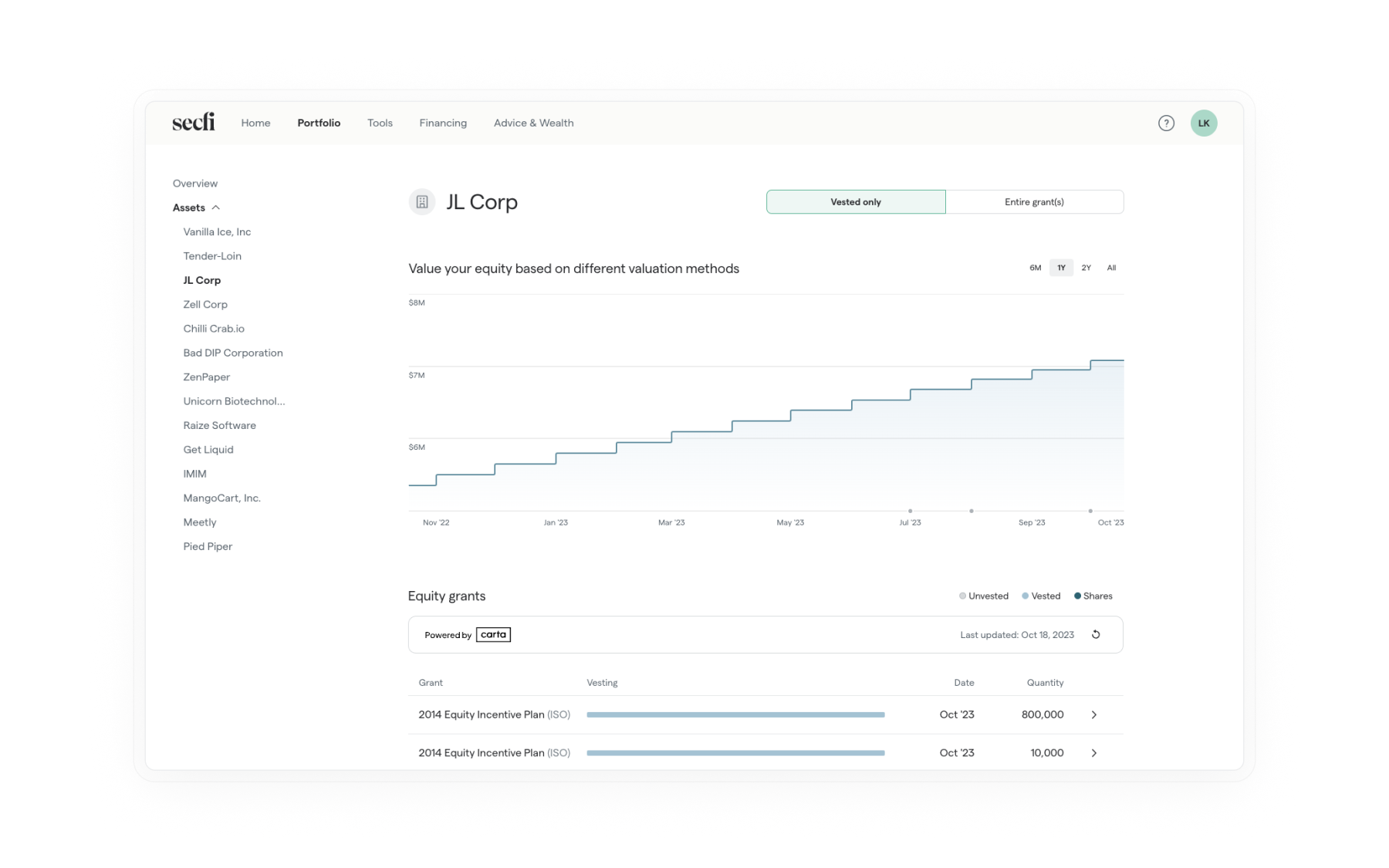

Carta’s Portfolio API allows Secfi users to effortlessly connect their Carta accounts and instantly import all their equity compensation data. This seeks to ensure that all information remains up-to-date without the need for manual updates or data entry. Any new grants Secfi users may receive will be imported over without ever lifting a finger.

Secfi has been on a mission from day one to demystify equity compensation and provide personalized wealth management and financing services for employees and executives. With the Secfi platform, they take back control and get the most value out of their equity compensation. To date, Secfi has helped over 40,000 startup employees with equity planning, representing nearly $45 billion in value.1 Nearly every major U.S.-backed venture-capital based company has employees using Secfi to create equity plans.2

Understanding the true value of equity compensation is a challenge that many employees in tech and at startups face. Without the right guidance and tools around personal equity planning and option financing, making informed decisions can be complex, potentially leading to millions of dollars in lost earnings and unnecessary taxes.

Seamlessly import accurate and up-to-date equity data

Secfi’s platform has insightful tools and calculators to make informed equity decisions, and is the first stop for requesting financing, help with secondary sales, and to connect with a financial advisor at Secfi Wealth.

This new integration helps ensure that the complex, but crucial, equity details are accurate to minimize onboarding time and allow startup employees to focus on what matters most: making better decisions about their equity and stock options.

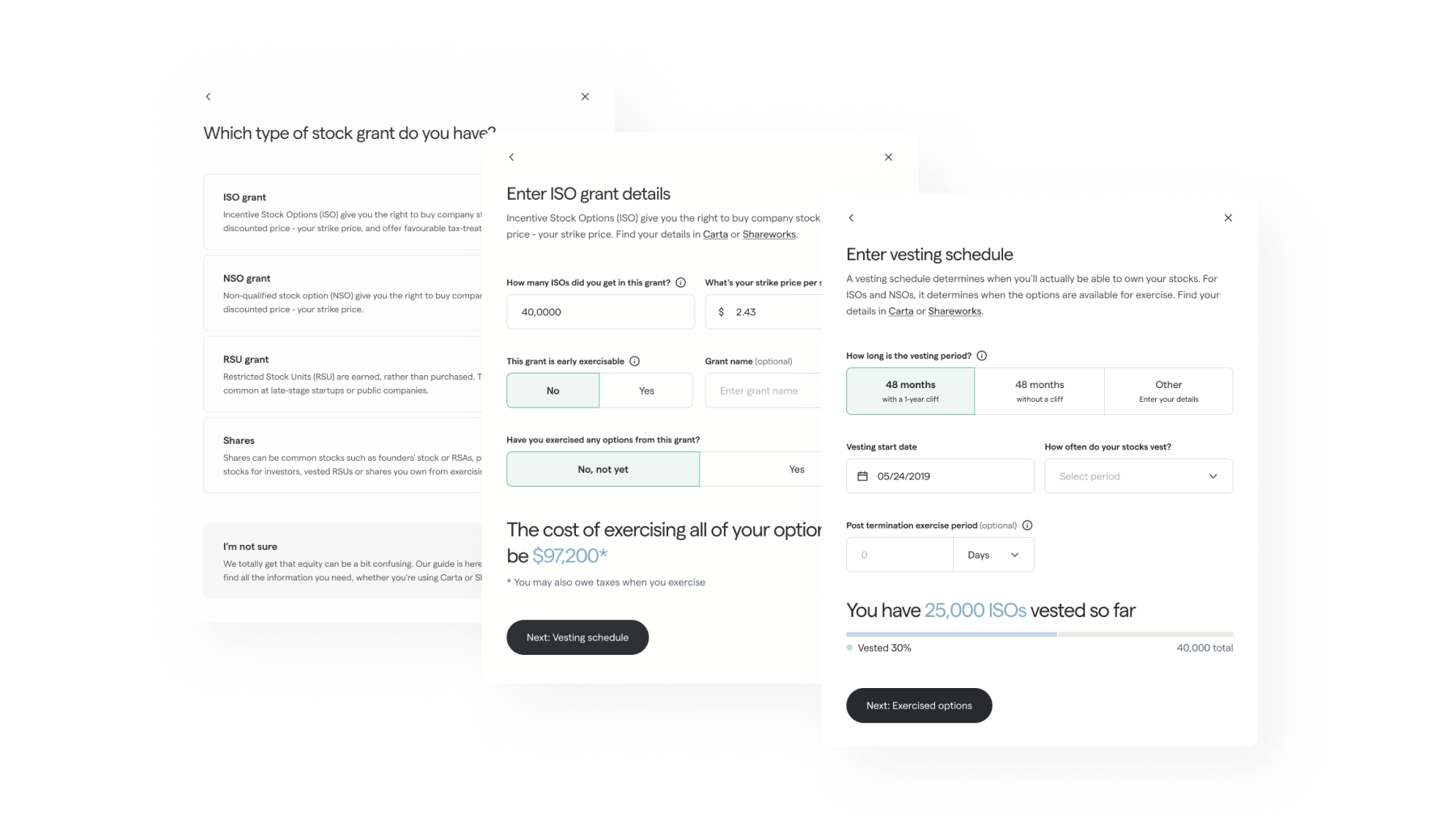

Importing equity information from Carta is just a few clicks away: