5 min

0 result

Getting proper information about what solutions are available for your equity can be very difficult. Companies do not often publish information or provide advice when it comes to your equity. This is usually for good reason as they can open themselves up to legal liability. As a startup ourselves, we know that can be frustrating for employees so we wrote a guide to provide what you need to know about solutions for your Egnyte shares or stock options.

When it comes to generating cash for liquidity purposes or to exercise your options, there are generally two possible solutions for your shares. The first is selling your shares in a secondary transaction. The second is entering into a financing agreement using your shares as collateral.

The most known way to generate cash from your shares is selling your shares today. Those who sell their shares may do so to generate cash for a large purchase such as for a home or to exercise their stock options. Some may sell to also diversify their holdings as your Egnyte equity is likely a large percentage of your assets today.

When it comes to the private markets, your shares are not freely tradeable like the public markets. In order to sell your shares, you’ll need to work with a broker to find a buyer. Brokers come in many forms - some are platforms that allow you to connect with buyers, some are individuals who work directly with you, and some are large teams that work on your behalf.

Each broker will charge a fee that’s usually a percentage of the total transaction volume which is standard in this industry. You should choose a broker that you trust has your best interests in mind and also understands the landscape for your company. The best brokers know Egnyte and the market intimately so they can negotiate the best price as well as execution on your behalf.

You’ll also need to navigate the company restrictions. Some companies allow shares to be traded with no restrictions. Some companies may impose restrictions and allow only certain transactions to go through. And some may outright block transactions. When it comes to Egnyte, there are some restrictions and the company may need to approve a sale. Your broker can help you evaluate whether you may be approved by the company or not.

Lastly, if you want to sell your shares, you’ll need to find a way to exercise them before you sell them. Some companies may allow what’s called a cashless transaction in which the sale proceeds are used to exercise, but the majority do not so you are on your own to exercise the options and pay any associated taxes.

If you want to learn more about selling your Egnyte shares, please contact our Equity Strategy team for a consultation.

We can help you sell your Egnyte shares

Sign-up to receive an estimate from our team

Get an estimateAn alternative to selling your shares is to enter into a financing agreement which is similar to borrowing money against your shares. Depending on your situation, financing to exercise your options or to generate liquidity may be an appealing alternative to outright selling the shares as you retain the upside associated. For purposes of this article, we’re going to focus on the non-recourse financing solution which means that your personal assets are not on the line if things do not go well with your Egnyte stock.

There are a few non-recourse financing providers out there including Secfi. Each company’s offerings differ slightly, but generally speaking the mechanics are largely the same. You enter into a financing agreement which provides a cash advance today and you only pay back the cash advance and associated fees after your company gets acquired or goes public. If the company goes bankrupt and your shares are worth $0, you pay back $0.

The structure is designed to be company friendly and there is no transfer of ownership of the shares so there is no company approval required. For Egnyte, Secfi offers non-recourse financing for liquidity purposes, option exercise, or a combination of both.

Employees and executives who are interested in getting some cash today, but retaining the upside in their shares may turn to a non-recourse financing solution. You will receive a cash advance today for a portion of the value of your shares. That cash can be used for discretionary spending such as buying a house or simply diversifying your investments.

When Egnyte goes public or gets acquired, you’ll pay back the cash advance along with fees. You retain the ownership of your shares in the financing transaction so you also maintain the upside associated in the shares.

Similar to the financing for liquidity, Egnyte employees who own unexercised stock options may turn to a non-recourse financing solution like Secfi’s for help exercising their options. Since Egnyte has grown so quickly, you likely own highly appreciated stock options with a low strike price. The downside to this is that by exercising you’re likely going to generate a large tax bill. The tax bill may be just a bit too large for you to handle or it may simply just be too risky for you to use your own cash to exercise.

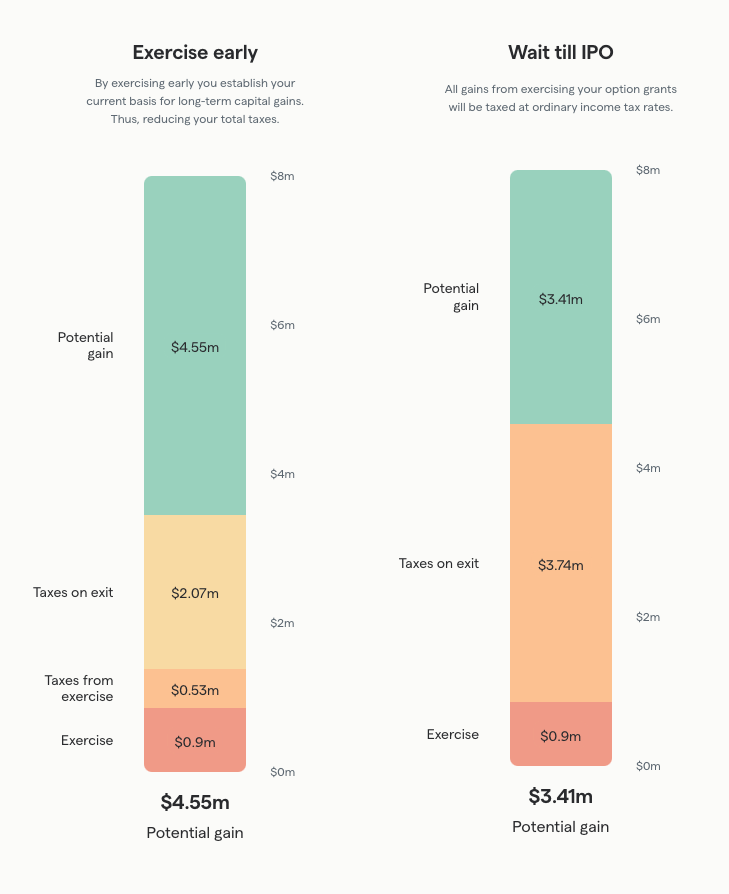

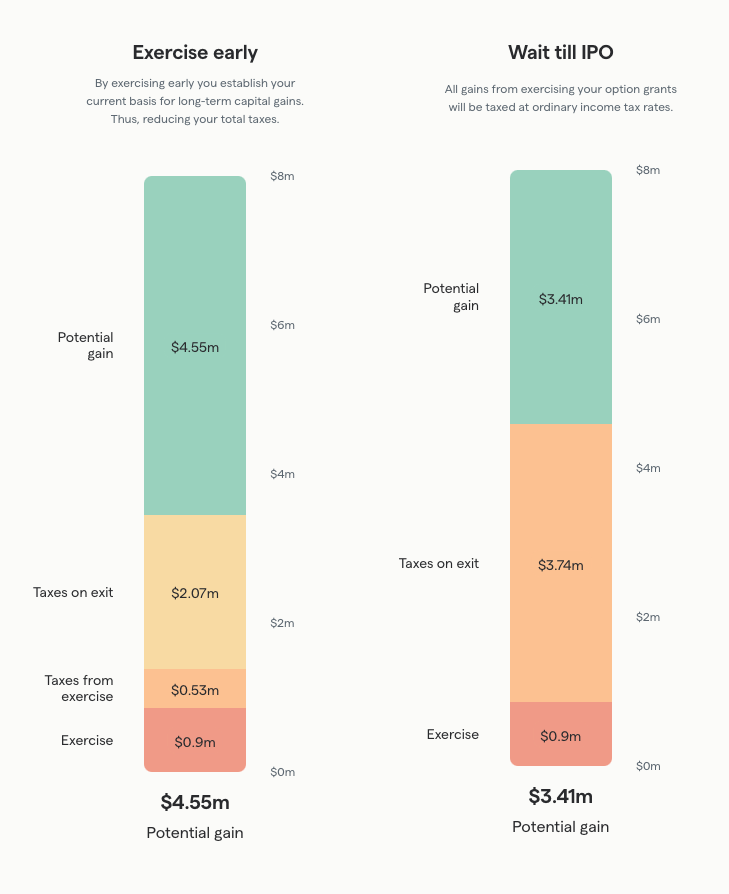

Since Egnyte options are highly appreciated, there are also significant potential tax benefits to exercising today. First, if the company continues to grow, it likely means that it will get even more expensive to exercise due to taxes as Egnyte approaches exit. Secondly, by exercising today, you can convert your appreciation to long-term capital gains which is the lowest possible tax rate you can pay.

See below for a sample employee comparing exercising options today versus waiting until an exit. The calculations assume the following:

Get your custom Egnyte exercise plan

Make it personal and get access to our full suite of equity planning tools.

Make your own comparisonAs you can see, there is a lot of potential tax savings for Egnyte employees. At Secfi, we look to try to create a win-win scenario as you’ll have significant tax savings by exercising today. Some of those savings will go to fees, but if all goes to plan, you’re going to have more money in your pocket than you would have if you didn’t exercise today. Of course, a lot of that is dependent on Egnyte continuing to perform and getting to an exit.

Finally… the million dollar question you are probably thinking right now.

Unfortunately, there’s no one size that fits all answers here. There are pros and cons to both selling and financing, and you’ll need to ultimately decide which is best for you. While this decision can be difficult, you should rest easy knowing that you’re in an enviable position at Egnyte in that you do have options! Furthermore, you don’t necessarily have to choose one or the other as a combination of both selling and financing is often the best answer for many.

You also don’t have to go at it alone. There’s lots of knowledgeable advisors out there including at Secfi that can walk you through all the pros and cons of each solution. We’d be more than happy to chat and discuss the solutions on the table for you.

Get advice for your stock options and equity

Work with one of our financial advisors on an as-needed basis to get help with your company equity.

Join the waitlist